The Perpetual Legacy Trust

Estate Asset Education Information

|

Eternal Legacy Trust The Perpetual Legacy Trust Estate Asset Education Information |

|

|

Eternal Legacy Trust Home |

Unique and

Creative Trust Strategies The Ideal Trust Management Environment for Success Experience & Proven Management Team Success Flexible, Individualized Cost-Effective Trust Services |

The Eternal Legacy Trust or "Perpetual Trust" for the Affluent Wishing an Eternal Gifting Legacy |

&

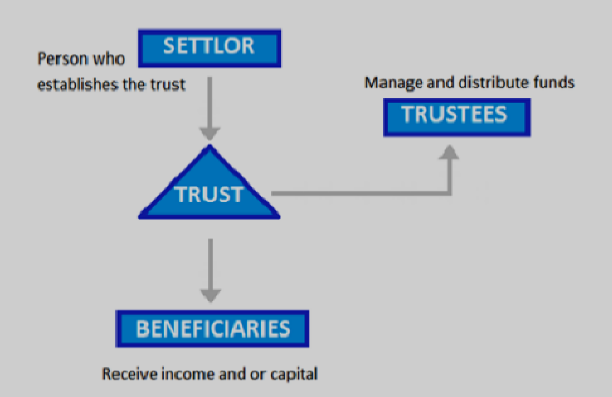

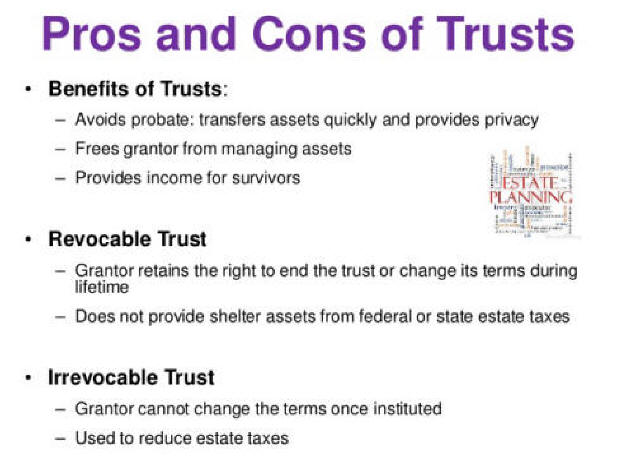

Trust Basics

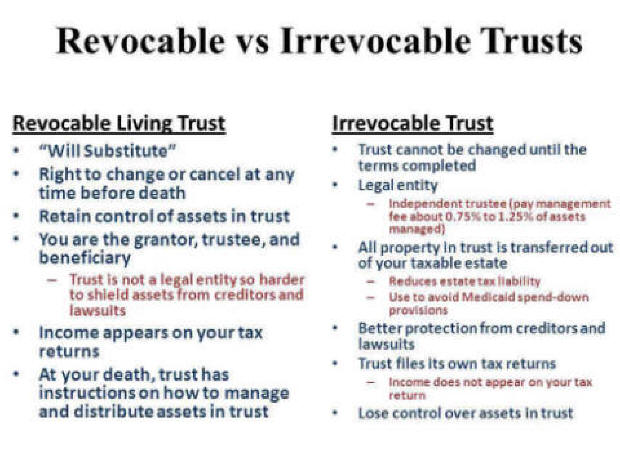

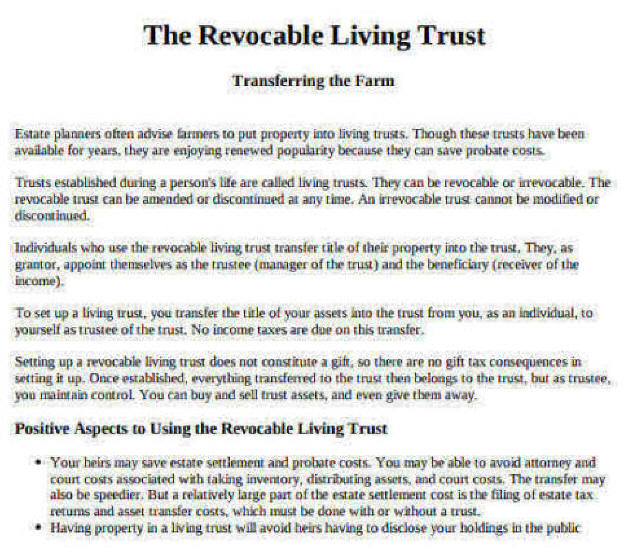

Revocable Trust Verses Irrevocable Trust

A-B Revocable Trust (Basic)

&

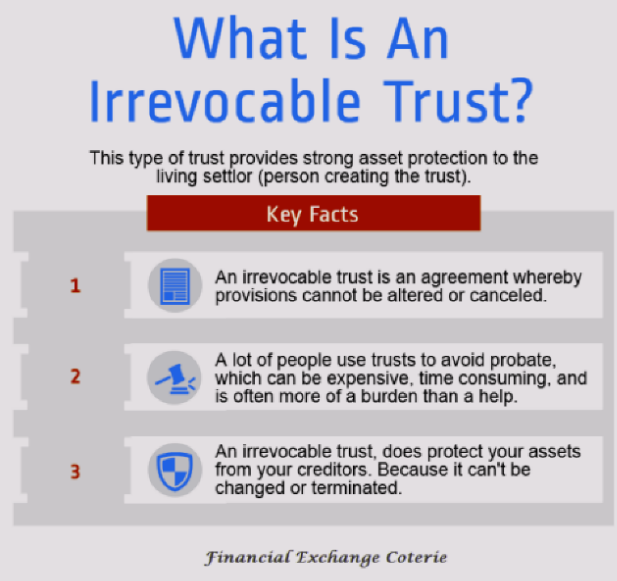

Irrevocable Trust

&

|

Stirpes verses per capita? Within a beneficiary designation, per capita typically means an equal distribution among your children. Per stirpes distribution uses a generational approach. ... With per stirpes, if one child were to precede you in death, the other child would receive half, and the children of the deceased child would get the other half, Per stirpes is used more commonly in estate planning than "per capita" because it covers the typical family situation. Make your intentions very clear to your attorney if you don't want this pattern as part of your estate plan. |

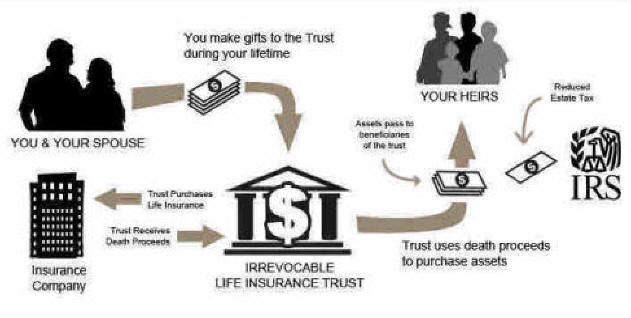

Common Life Insurance Irrevocable Trust

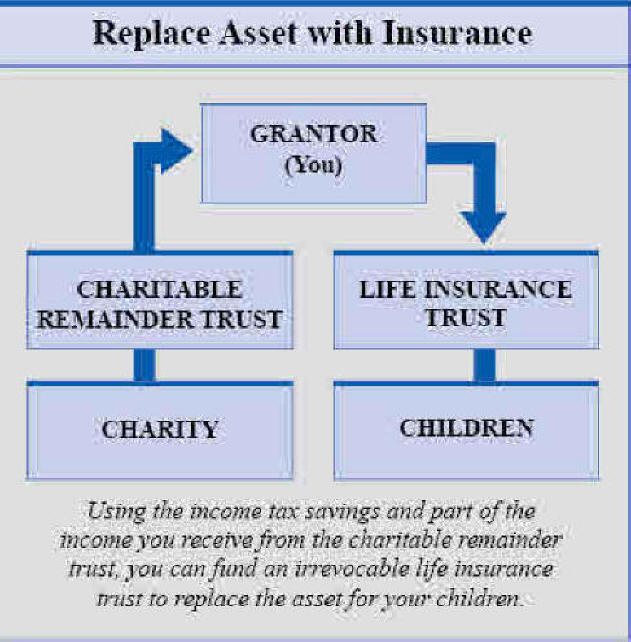

Asset Replacement Life Insurance Irrevocable Trust

Irrevocable Private Trust Fund

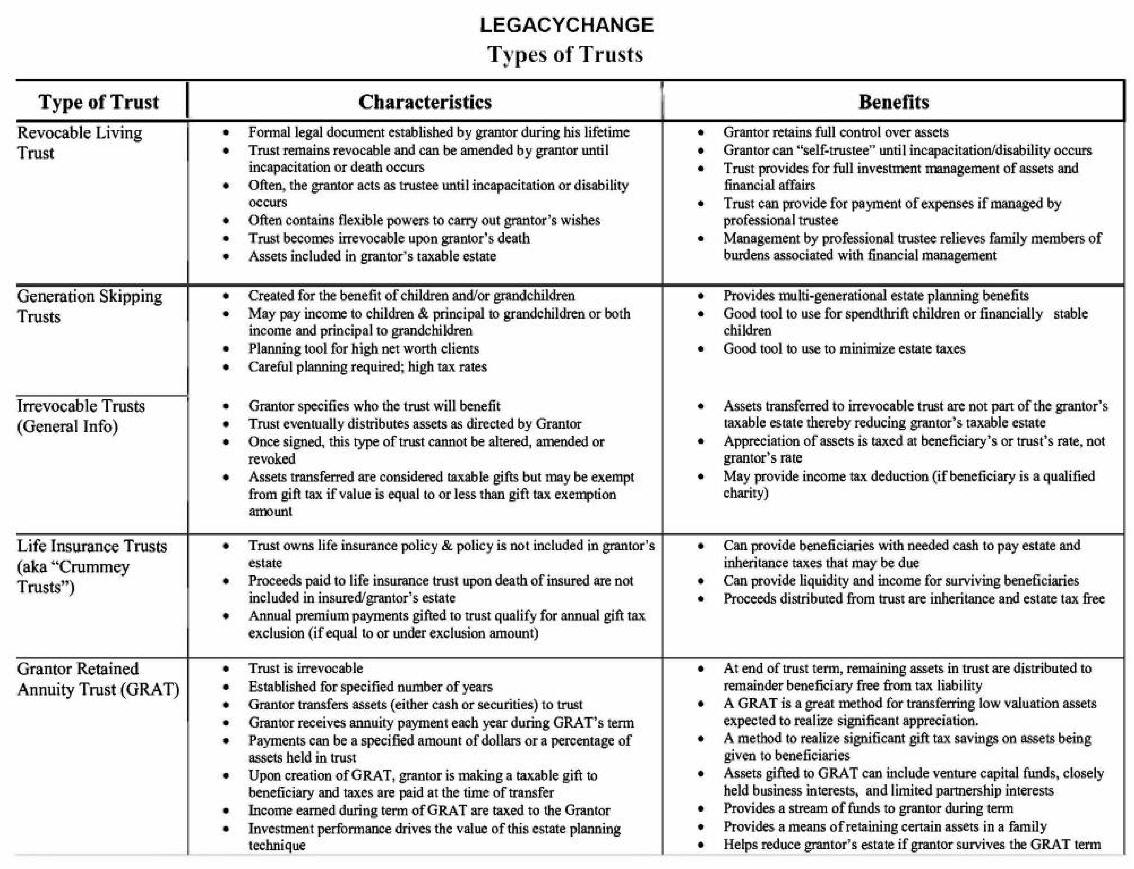

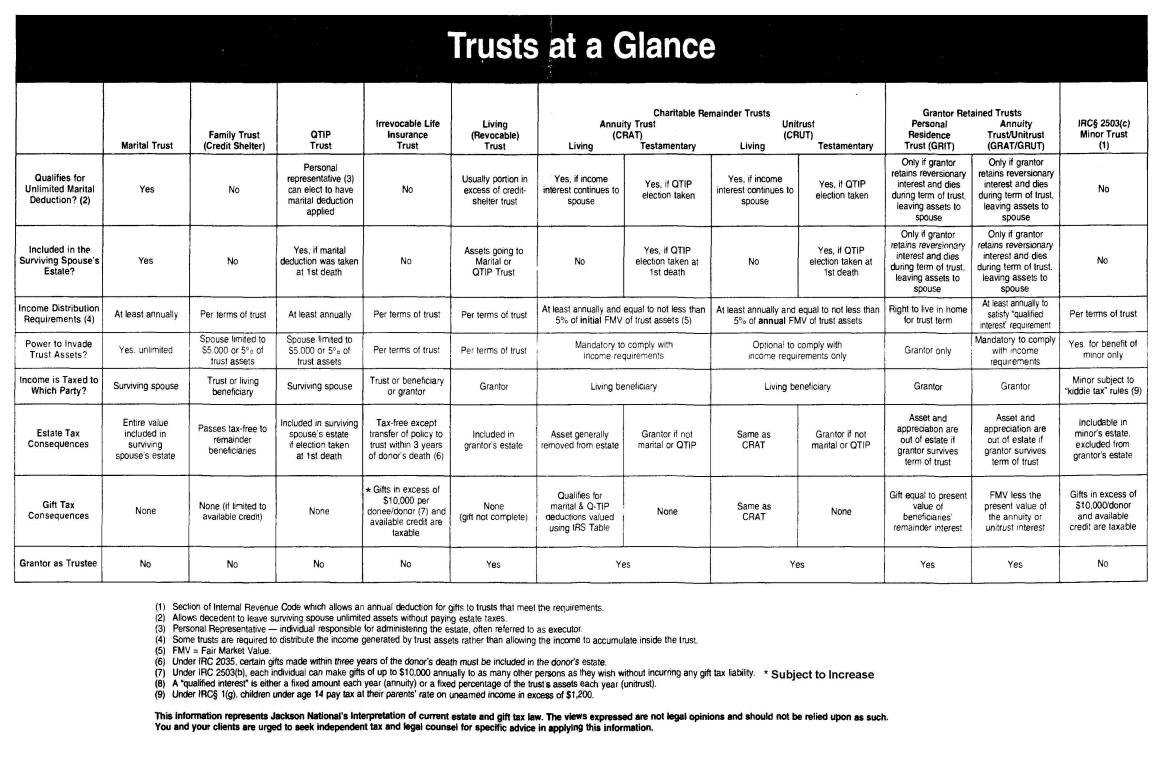

Other Types of Trusts

|

A recent article from Kiplinger, “Pre-Election Estate Planning Moves for High Net-Worth Families,” describes an extensive selection of trusts that can are used to protect wealth, and despite the title, not all of these trusts are just for the wealthy. The time to make these changes is now, since there have been many instances where tax changes are made retroactively—something to keep in mind. The biggest opportunity is the ability to gift up to $11.58 million to another person free of transfer tax. However, there are many more. Spousal Lifetime Access Trust (SLAT) The SLAT is an irrevocable trust created to benefit a spouse funded by a gift of assets, while the grantor-spouse is still living. The goal is to move assets out of the grantor spouse’s name into a trust to provide financial assistance to the spouse, while sheltering property from the spouse’s future creditors and taxable estate. Beneficiary Defective Inheritor’s Trust (BDIT) The BDIT is an irrevocable trust structured so the beneficiary can manage and use assets but the assets are not included in their taxable estate. Grantor Retained Annuity Trust (GRAT) The GRAT is also an irrevocable trust. The GRAT lets the grantor freeze the value of appreciating assets and transfer the growth at a discount for federal gift tax purposes. The grantor contributes assets in the trust and retains the right to receive an annuity from the trust, while earning a rate of return as specified by the IRS. GRATs are best in a low interest-rate environment because the appreciation of assets over the rate goes to the beneficiaries and at the end of the term of the trust, any leftover assets pass to the designated beneficiaries with little or no tax impact. Gift or Sale of Interest in Family Partnerships. Family Limited Partnerships are used to transfer assets through partnership interests from one generation to the next. Retaining control of the property is part of the appeal. The partnerships may also be transferred at a discount to net asset value, which can reduce gift and estate tax liability. Charitable Lead Trust (CLT). The CLT lets a grantor make a gift to a charitable organization while they are alive, while creating tax benefits for the grantor or their heirs. An annuity is paid to a charity for a set term, and when the term expires, the balance of the trust is available for the trust beneficiary. Charitable Remainder Trust (CRT) The CRT is kind of like a reverse CLT. In a CRT, the grantor receives an income stream from the trust for a certain number of years. At the end of the trust term, the charitable organization receives the remaining assets. The grantor gets an immediate income tax charitable deduction when the CRT is funded, based on the present value of the estimated assets remaining after the end of the term. These are a sampling of the types of trusts used to protect family’s assets. Your estate planning attorney will be able to determine if one is right for you and your family, and which one will be most advantageous for your situation. Reference: Kiplinger (Aug. 16, 2020) “Pre-Election Estate Planning Moves for High Net-Worth Families” |

Assisting to Preserve, Maintain and Build Client Wealth

&

Receive Perpetual Legacy Trust News and Updates Subscribe Here

&

Free Will Consultation & Discounted Trust by Experienced Local Estate Advisors

Advanced Asset Funding for Heirs: www.AdvanceInheritFunding.com

Eternal Legacy Trust

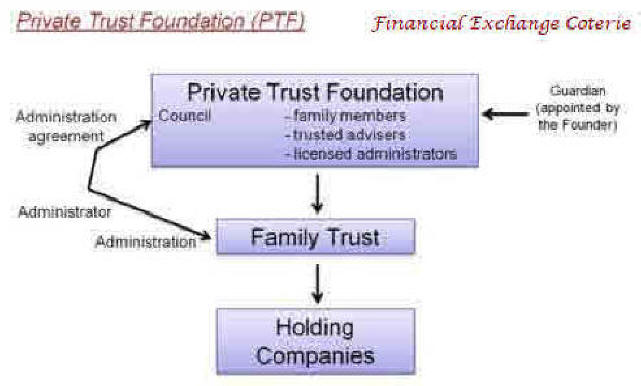

Financial Exchange Coterie (FEC) - 1031FEC

Tax Reduction Services

Florida International Trade Center

5206 Station Way Sarasota, FL 34233-3232

------------------------

National: 800.333.0801 or 941.227.3024

Ken Wheeler Jr. Mobile 515.238.9266

Trust Office: 941.363.1375

Fax: 888.898.6009

Skype: kenneth.wheeler65 E-mail

LinkedIn: www.linkedin.com/in/kenwheeler65/

Licensed Real Estate Broker Florida BK3284149

C.P.R.E.S

-----------------------------------

Tax Reduction Services - Business Entry-Management-Exit Plans - BEME

Veteran

Copyright © 2018 - 2021 K. B. Wheeler Jr. All rights reserved 3-10 5-D