|

FEC

LegacyChange

by Insured Grace Contract Simplified Estate Asset Plans LegacyChange.com Home Save Tax Insured-Economical-Efficient Flexible Asset Transfer Through a Non-Profit Asset Transfer Organization |

|

Special Beneficiaries Income Plan

Simplified Estate Asset Plans * Tax Deductible * Guaranteed Income

Save Tax

Return to LegacyChange Home Page

&

|

Selling Assets To

Settle Divorce Action?

LegacyChange Plans can take the sting out of Ordinary Income Tax (Annuity & Retirement Plans)

LegacyChange Plans can take the sting out of Gain & Recapture Tax (Stocks, Mutual Funds, Businesses) Offset the tax consequences Provide structured inheritance for client property division, heirs, beneficiaries Guaranteed income stream Insured Support client's favorite charity

A ppropriate planning can make the difference when taxes are an issue. Talk to an LCP representative about how our programs can benefit your clientsWe inform and can assist for efficient economical transfer of asset ownership. |

&

|

|

|

&

|

Are You Feeling the Pain of a Roth Conversion or Divesting Retirement Plan?

LegacyChange Plans can take the sting out of a Retirement Plan Conversion Offset the tax consequences of Roth Conversion or plan distributions. Death Tax Deduction. Guaranteed income stream. Insured. Provide structured inheritance for heirs. Support client's favorite charity. Appropriate planning can make the difference when taxes are an issue. Talk to an LCP representative about how our programs can benefit your clients.

By the end of 2019, over $15 trillion worth of inheritance will pass through the probate courts in America. The #1 asset sold first is the real estate.

We inform and can assist for efficient economical transfer of asset ownership. |

&

Asset Transfer - Non-Tax Burden - Insured Giving Legacy - Keep Estate Planning Private

&

Confidentiality Agreement (pdf)

&

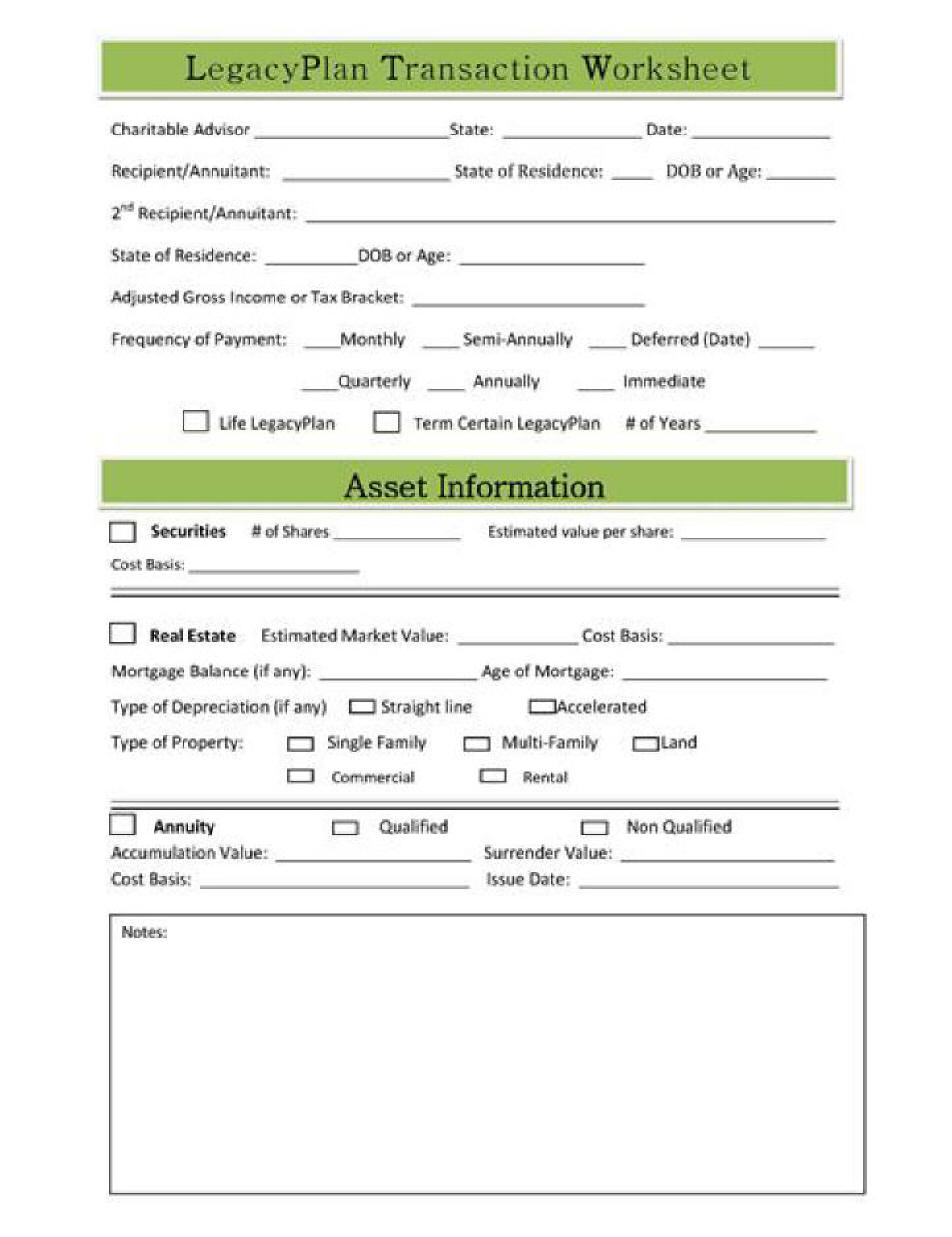

LegacyPlan Transaction Worksheet for Illustration (pdf)

&

Answer the few questions on this Transaction Worksheet and

see if a LegacyChange Plan could fit into client retirement plans!

LegacyPlan Transaction Worksheet for Illustration (pdf)

Minimizing Inheritance Conflict

Not all programs are available in every state. LegacyChange, 1LessTax or 1031FEC do not provide tax or legal advice.

LegacyChange Plans are not FDIC insured or Investments

Tax and Legal Advisers Recommended. We can assist finding attorney.

Advanced Asset Funding for Heirs Go Here: Cash Advance

Go to Incentive Plan

Return to LegacyChange Home Page

Receive LegacyChange News and Updates Subscribe Here

For Tax Updates and News on Facebook View @1LessTax

More Tax Saving Alternatives at www.1LessTax.com See Page 3

Free Consultation & Discounted Experienced Local Estate Advisors

Legacy Change

Financial Exchange Coterie (FEC) - 1LessTax - 1031FEC

Florida International Trade Center

5206 Station Way

Sarasota, FL 34233-3232

------------------------

Tax Reduction Services

Direct: 515.238.9266 National: 800.333.0801

Message 941.227.3024 Fax: 888.898.6009

Skype: kenneth.wheeler65 E-mail: info@1LessTax.com

LinkedIn: www.linkedin.com/in/kenwheeler65/

******************

Licensed Real Estate Broker Florida BK3284149

Business Entry-Management-Exit Plans - BEME

Tax Reduction

Services - Legal - Estate

- Tax

C.P.R.E.S

Return to LegacyChange Home Page

Copyright © 2018-2022 K. B. Wheeler Jr. All rights reserved 3-10 5-D 6